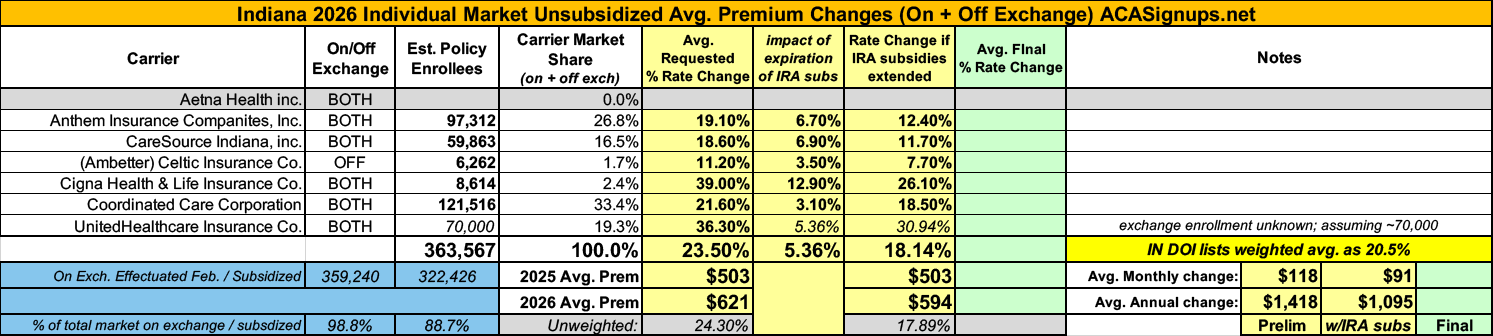

2026 Rate Changes - Indiana: +20.5%; 5.4 pts due specifically to IRA subsidy expiration (prelim)

via the Indiana Dept. of Insurance:

Rate Watch is a convenient way for Hoosiers to access key data on Accident and Health rate filings submitted to the IDOI on or after May 1, 2010. Use it to determine which companies have requested rate changes, their originally requested overall % rate change, and the overall final % rate change approved. These are overall rate changes and are not individually specific. The table below is searchable and sortable. You can also download your filtered results by pressing the Save Excel File button at the bottom of the table. If you need the full data set, including a few additional columns, you can download the CSV file.

...INDIANA 2026 ACA FILINGS

The overall requested average rate increase for 2026 Indiana individual Marketplace plans is 20.5%. This year's requested rate increases were substantially impacted by the assumptions that for 2026 Congress will not continue enhanced premium subsidies available to Hoosiers under the American Rescue Plan Act and the Inflation Reduction Act and that Congress will fund Cost Sharing Reductions.

Note: As of this writing, it does not look like Congress will be funding Cost Sharing Reductions (CSR), which makes that 20.5% increase even more concerning...

The IDOI will finalize the review of the 2026 ACA compliant filings both on and off the federal Marketplace by August 15, 2025. The Centers for Medicare and Medicaid Services (CMS) will issue the ultimate approval for the Marketplace plans sold in Indiana. CMS will issue its approval on or before September 17, 2025.

- The medical trend increase ranges from 4.3-12.1%. This varies depending on networks and experience of each carrier.

- The premium averages shown consist of a combination of catastrophic, bronze, silver, gold and platinum plans. The premium is reflected as an average; individuals may experience a rate increase or decrease dependent on the plan selection or auto-enrollment process.

- Within each metal level there are numerous plans with various cost sharing methods.

- Cigna Health and Life Insurance Company increased the number of covered counties from 8 in 2025 to 15 in 2026

- UnitedHealthcare Insurance Company increased the number of covered counties from 9 in 2025 to 16 in 2026.

- Aetna Health, Inc. will not offer plans on the Individual Marketplace for Policy Year 2026.

- Celtic Insurance Company will offer Individual Off Marketplace plans only.

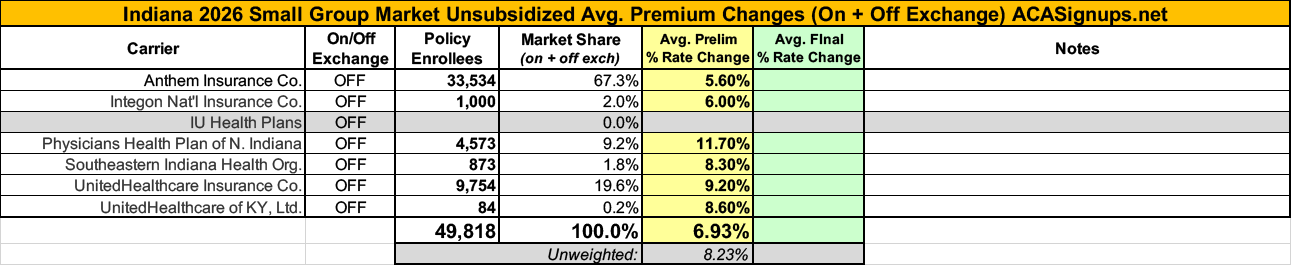

- IU Health Plans will not offer ACA Small Group plans for Policy Year 2026.

Anthem Insurance Co:

Scope and Range of the Rate Increase

Anthem Insurance Companies, Inc. (also referred to as Anthem) has made an application to the Indiana Department of Insurance for premium rate changes for its fully ACA-compliant individual health plan products. This rate change will impact approximately 107,900 current Indiana insured members renewing in 2026 with Anthem. This filing includes an average rate change of 19.1%, excluding the impact of aging, effective January 1, 2026. At the individual plan level, rate changes range from -28.7% to 38.5%. An individual’s actual rate could be higher or lower depending on the geographic location, age characteristics, dependent coverage and other factors.

Morbidity Adjustment

...The projected population consists of expected retention of existing policies and new sales. New entrants include the previously uninsured population, grandfathered policies voluntarily migrating to ACA-compliant plans, and previously insured populations from other carriers or markets. The morbidity adjustment reflects projected Anthem and market changes in morbidity, including changes from the expiration of the enhanced ACA premium tax credits on December 31, 2025. Selective lapsation is expected to increase morbidity of the risk pool as a disproportionate number of healthy enrollees is expected to leave the market due to increases in their net premiums after subsidies and economic considerations. The cumulative morbidity factor can be found in Exhibit E, which is 6.7% of claims.

CareSource Indiana:

This document contains the Part II written description justifying the rate increase subject to review on CareSource Indiana, Inc.’s (CIN) individual medical block of business, effective January 1, 2026. The average proposed rate increase is 18.6% and varies based on age, geographic region, and plan selection. There are 59,863 members currently enrolled that will be affected by the rate change. CIN has historically been profitable in this market, however costs for services and the number of services for both medical and pharmacy benefits have increased significantly and is the major contributor to this rate action. Changes in benefits are not a major contributor to the rate action and are within the bounds defined by CMS’ Final AV Calculator instructions. The expiration of ARPA and the resulting assumed reduction in total marketplace membership is a driver of administrative expenses increasing in this filing.

...Approximate 2025 to 2026 Rate Change Development:

- Experience 2.7%

- Trend 11.5%

- Plan Benefit Relativity -3.0%

- Morbidity 5.3%

- Risk Adjustment -6.8%

- Retention 1.7%

- Other Factors 0.3%

- ARPA Expiration 6.9%

Cigna Health & Life:

The most significant factors causing the rate increase are:

• Expiration of APTC Subsidies: This rate filing assumes that APTC subsidies will expire on 12/31/2025. The conclusion of the enhanced subsidies is expected to lower enrollment and increase the average statewide morbidity.

• Changes in Medical Service Costs: The increasing cost of medical and pharmacy services and supplies accounts for a sizeable portion of the premium rate increases. Cigna anticipates that the cost of medical and pharmacy services and supplies in 2026 will increase over the 2024 level because the prices charged by doctors, hospitals, and other providers are increasing. Additionally, the more frequent use of medical services by customers also increases Cigna's costs. The recent increase in Consumer Price Index (CPI) inflation is adding additional inflationary pressure for network contracts and provider payment mechanisms.

• Changes for the healthiness of the population: The health exchanges for individual plans continue to evolve, following the introduction of the Patient Protection and Affordable Care Act. The overall health of the population is significantly impacted by changes in:

- enrollment decreases from year to year, as this tends to increase the average healthcare cost of the remaining market enrollees

- anticipated changes to regulations regarding things like Short Term Medical and Association Health Plans that will impact the Affordable Care Act population are likely to attract healthier consumers away from the individual market, which increases the average healthcare cost per customer

• Plan design changes and benefit modifications: Changes have been made to plans that are resulting in an increase in expected cost share and therefore an increase to premium. All plan designs conform to actuarial value and essential health benefit requirements.

Coordinated Care Corp:

Consistent with the October 12, 2017 payment memo from the U.S. Department of Health and Human Services (HHS), the premium rates developed and supported by this Actuarial Memorandum assume that cost-sharing reduction (CSR) subsidies will not be funded and enhanced Advanced Premium Tax Credits (eAPTCs), as provisioned under the Inflation Reduction Act, expire on December 31, 2025 consistent with current law and regulations in effect or otherwise scheduled to take effect in plan year 2026.

Additionally, these rates assume that CMS’ Marketplace Integrity and Affordability rule, published in the Federal Register on March 19, 2025, is finalized as proposed - including key rule changes regarding open enrollment, special enrollment periods, and annual eligibility redeterminations.

Rates also reflect benefit designs and cost-sharing structures aligned with the revised de minimis actuarial value (AV) ranges specified in the proposed rule for the 2026 plan year.

Celtic Insurance Co (Ambetter):

Impact of eAPTC Expiration

To account for eAPTC expiration prior to the 2026 benefit year, we have assumed rates will increase due to anticipated reductions in enrollment, both at the issuer and single risk pool level. As eAPTCs expire and enrollees subsequently face increased out-of-pocket premiums, we assume healthier individuals who tend to be more price sensitive will leave the market, worsening the average morbidity of the individual risk pool.

...Under an alternate scenario where eAPTCs are funded for plan year 2026 and CMS’ proposed rule is implemented without modifications, shifts in statewide average morbidity is expected to increase the Index Rate by 3.4% between the base and projection period. Key provisions included in the proposed rule related to open enrollment, special enrollment periods and annual eligibility redeterminations (e.g. requiring $5 premium obligation for auto re-enrollees) are still expected to drive a meaningful decline in enrollment, particularly among healthier enrollees and adversely affect the average morbidity of the single risk pool.

The overall average rate change under this alternate scenario is 7.7%, compared to 11.2% in the baseline scenario reflected in this memorandum. The difference in average rate changes also reflects other varying assumptions between scenarios, such as administrative expenses and other demographic factors.

Unfortunately, the UnitedHealthcare filing doesn't seem to be available, so I've had to plug in an educated guess as to how many UHC enrollees Indiana has on their individual market. Since there are around 360,000 on-exchange enrollees, the UCH number has to be around 70,000 or so in order to put the grand total over that amount...except that doing so also makes the weighted average 2026 rate hike 23.5%, when the IN DOI clearly states that it's actually a bit lower, at 20.5%.

In any event, the IN sm. group market carriers are asking for an average increase of 6.9%