How much more will CALIFORNIA residents pay if the improved #ACA subsidies aren't extended?

It was in early 2021 that Congressional Democrats passed & President Biden signed the American Rescue Plan Act (ARPA), which among other things dramatically expanded & enhanced the original premium subsidy formula of the Affordable Care Act, finally bringing the financial aid sliding income scale up to the level it should have been in the first place over a decade earlier.

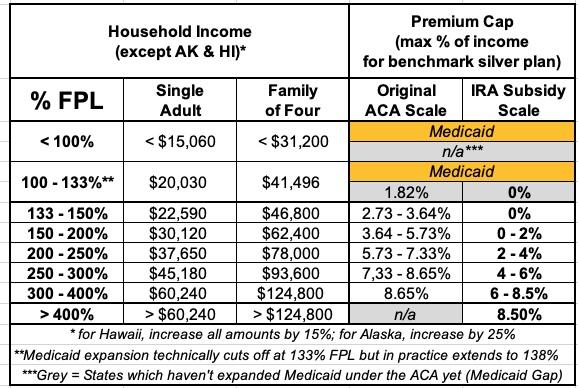

In addition to beefing up the subsidies along the entire 100 - 400% Federal Poverty Level (FPL) income scale, the ARPA also eliminated the much-maligned "Subsidy Cliff" at 400% FPL, wherein a household earning even $1 more than that had all premium subsidies cut off immediately, requiring middle-class families to pay full price for individual market health insurance policies.

Here's what the original ACA premium subsidy formula looked like compared to the current, enhanced subsidy formula:

Unfortunately, the ARPA's subsidy enhancements included a major caveat: They were only in place for three years, originally scheduled to terminate effective December 31, 2023 (they were retroactive to the beginning of 2021).

The good news is that this sunset date was bumped out by another three years as part of the Inflation Reduction Act (IRA) passed in 2022. The bad news is that this extension is currently scheduled to end effective December 31, 2025. Needless to say, with Trump winning reelection and Republicans about to gain a trifecta, it's highly unlikely that the IRA's enhanced subsidies are going to be be extended further.

I decided to run the numbers myself to get an idea of just how much enrollees real-world health insurance premiums are likely to increase starting in January 2026 if the upgraded ARPA/IRA subsidies expire at the end of 2025.

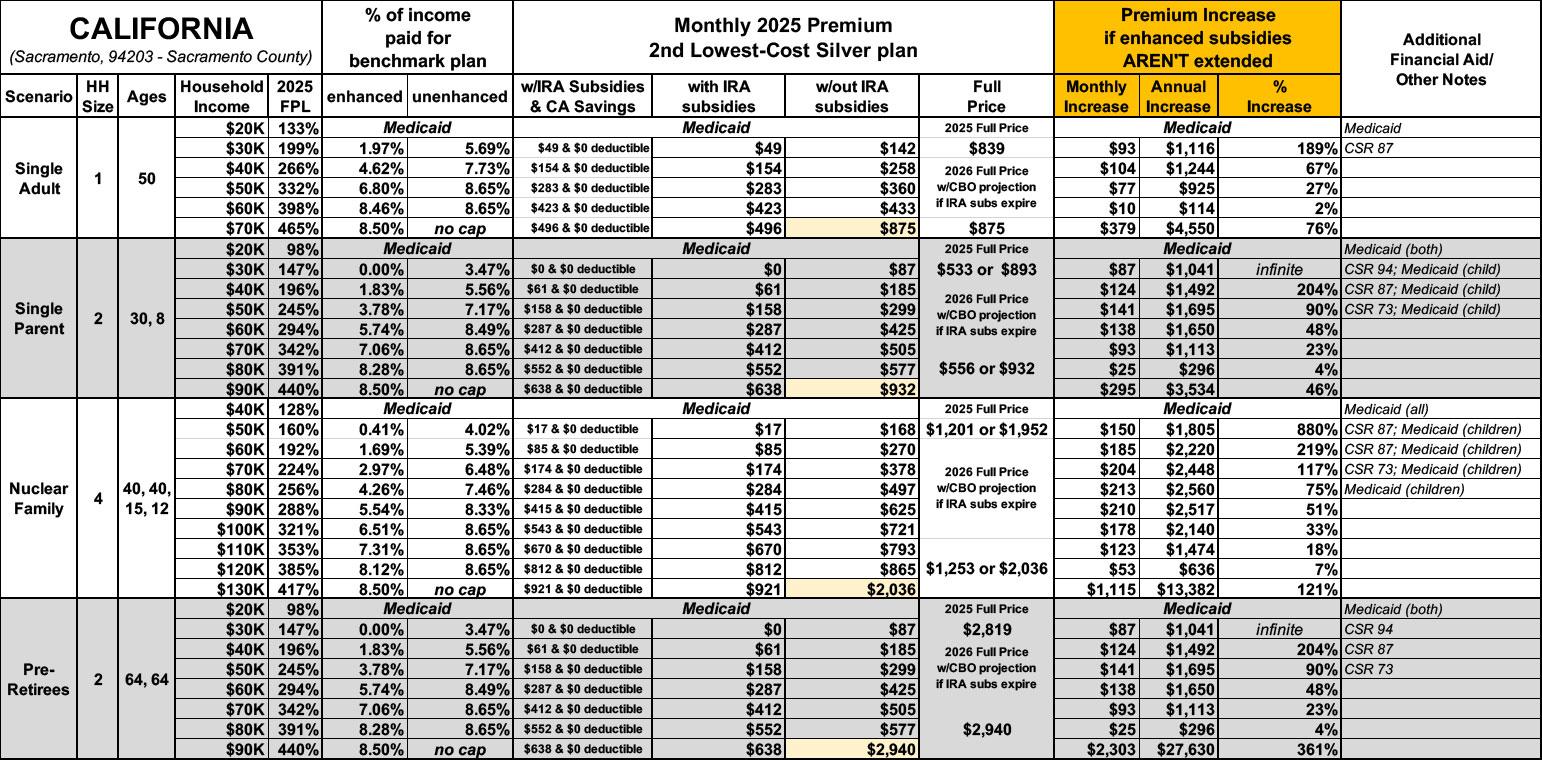

For this analysis, I'm using four household scenarios, at several different income levels for each:

- a 50-yr old single adult earning between $20K - $70K/year

- a 30-yr old single parent w/an 8-yr old child, earning between $22K - $90K/year

- a 40-yr old couple w/2 children age 15 & 12, earning between $40K - $130K/year

- a 64-yr old couple earning between $21K - $90K/year

To calculate these, I'm using a combination of KFF's Subsidy Calculator, HealthCare.Gov and the various state-based ACA exchange websites.

There's several caveats involved here.

- Both the Federal Poverty Levels (FPL) and average Benchmark Silver ACA premiums are as of 2025. For 2026, the first year that the impact of the enhanced subsidies ending would actually go into effect, FPL levels will be a bit higher, and the benchmark Silver premiums will likely be higher in most states as well due to normal factors like inflation/etc.

- In addition, the Congressional Budget Office just issued a new analysis which estimates that unsubsidized premiums will increase by an additional 4.3% on average nationally in 2026 if IRA subsidies expire in 2025. This would vary by state and carrier, but I'm tacking on an extra 4.3% to all Full Price estimates below.

- Benchmark Silver premiums vary widely from state to state, Rating Area to Rating Area, county to county and potentially even from zip code to zip code in some states. Not every plan is offered throughout an entire rating area, which can impact which Silver plan is considered the Benchmark for that area.

- I'm therefore picking a single zip code for each state...based on the capital cities. Note that the capital is also the largest city in some states but not in others.

- "Single Parent" and "Nuclear Family" scenarios: In some states, children under 19 are eligible for CHIP or Children's Medicaid at a significantly higher household income level (in some states they're eligible up to 200% FPL or more). This often means that there's a sudden jump in the full-price premiums as the household income moves over the Children's Medicaid/CHIP eligibility threshold.

- These analyses assume that the enrollees choose the benchmark Silver plan. In many cases they'd be better off choosing a Gold or Bronze plan (or even Platinum, although those aren't even available in most states).

OK, with all that understood, let's take a look (note: "infinite" simply means that the net monthly premium for that household would go from $0 (free) to some number higher than $0...which technically means their premium would increase "infinity percent" even if it only went from $0 to $1/month).

Instead of going alphabetically, I've decided to analyze the states from lowest to greatest net premium increases for the most dramatic case study.

With that in mind, here's what it would look like in CALIFORNIA.

Note: Like some other states, California has their own supplemental state-based ACA financial subsidies on top of the federal APTC & CSR assistance. In CA's case, the additional help doesn't impact actual premiums, but instead wipes out deductibles across the board for pretty much every exchange enrollee:

In 2024, California implemented its first-ever state-funded enhanced cost-sharing reduction (CSR) program. For Californians at or below 250 percent of the federal poverty level, the program improved health care affordability and access to care by eliminating deductibles in all three Silver CSR plans. It also lowered generic drug costs and copays for medical visits and reduced other out-of-pocket costs. To date, over 800,000 Californians have benefited from the program.

This year, Gov. Newsom and the California Legislature increased the amount of state funds available for the enhanced cost-sharing reduction program, appropriating $165 million to expand eligibility for it. As a result, in 2025 Californians with incomes above 200 percent of the federal poverty level (FPL) will be eligible to enroll in an Enhanced Silver 73 plan with no deductibles and reduced out-of-pocket costs, while those under 200 percent FPL will continue to have access to higher levels of benefits. This change will further reduce financial barriers to accessing health care and simplify the process of shopping for health insurance.

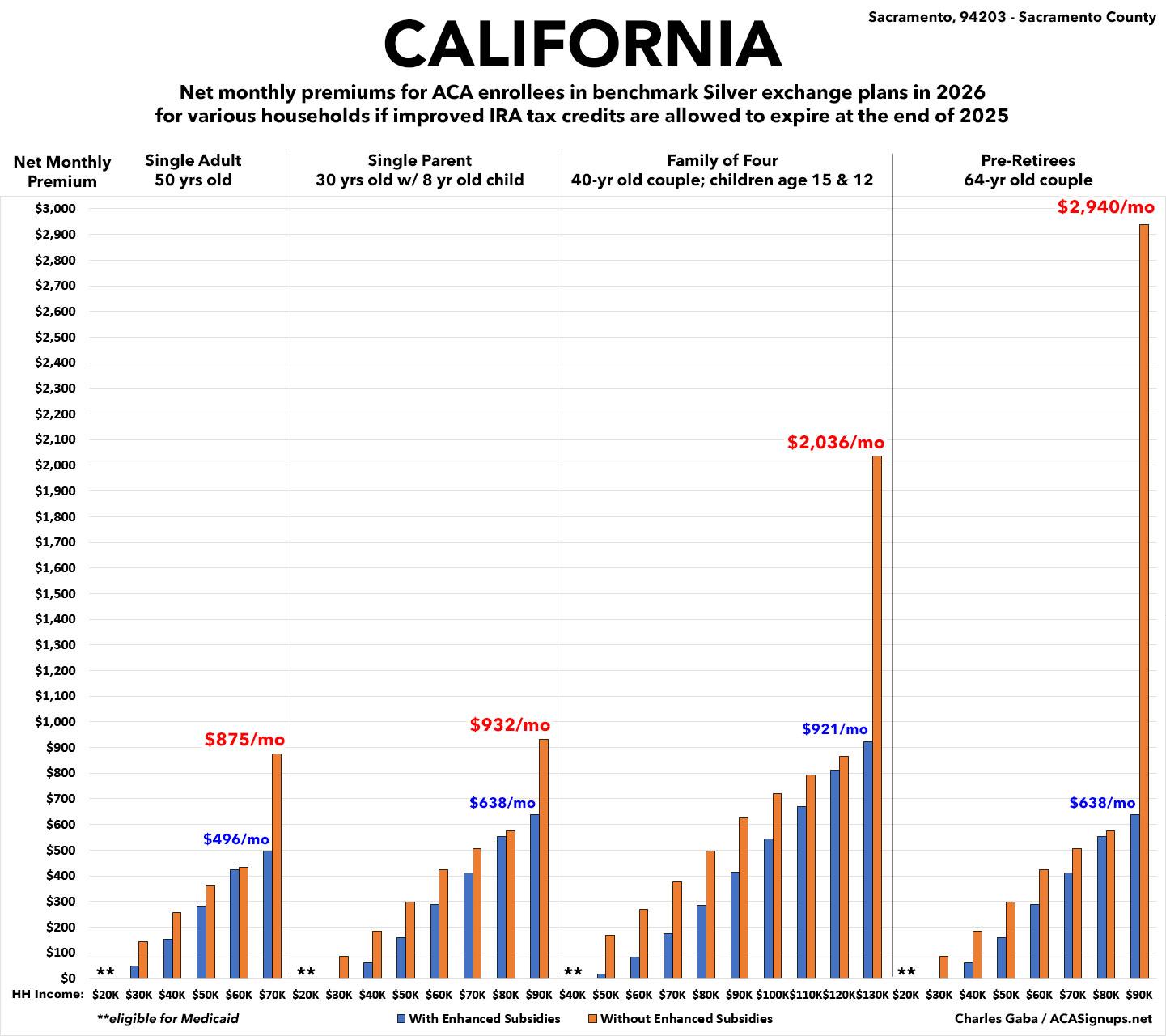

I've added a third column in the table below for the IRA + CA CSR subsidy scenario, but only have the 2nd and third scenarios displayed in the bar graph below since the graph only represents premiums, not deductibles or other out of pocket expenses:

In California, If the IRA subsidies go away, starting in 2026...

- A single 50-yr old earning $40,000/yr would see his premiums jump from $154/month to $258/month...a 67% hike.

- A single parent earning $40,000/year would go from paying $61/month to $185/month...TRIPLE what they're paying now.

- A family of four earning $60,000/year would see their premiums jump from $85/month to $270/month...3.2x as much.

- A 64-yr old couple earning $90,000/yr would have to shell out OVER $27,000 MORE per year for the same coverage...or 4.6x AS MUCH as they're paying this year!

California currently has nearly 1.7 MILLION residents enrolled in subsidized ACA exchange plans (plus another ~215,000 paying full price). They also have an additional ~5 MILLION residents enrolled in Medicaid via ACA expansion, for a total of 17.9% of their entire population covered via ACA healthcare plans.