Good News: HealthCare.Gov Window Shopping is LIVE! Bad News: HealthCare.Gov Window Shopping is live.

On Monday I noted that around 20 state-based ACA exchange websites had launched 2026 Open Enrollment "window shopping," which allows residents to plug in their household information (zip code, ages, income, etc) and browse the various health insurance policies they have to choose from for coverage starting January 1st...as well as whatever federal (and state, in some cases) tax credits they'll be eligible for.

This morning, the number of states with live window shopping (including DC) grew to 49, as HealthCare.Gov, which hosts ACA enrollment for 30 states, went live. (This leaves 2 states left to bring their window shopping tools online: Colorado and Pennsylvania, both of which should do so by Saturday at the latest).

Between the expiring federal tax credits, the stingier MOOP formula and the other oddball administrative changes being imposed by the Trump Regime, it's not a pretty picture.

I've spent the better part of the past year putting together estimated examples of how much net premiums will likely skyrocket for various households; now it's time to see how accurate those estimates were using some real world examples.

I'm going to once again put that absurd 2013 Wall St. Journal graphic to positive use by looking at four households here in my home state of Michigan:

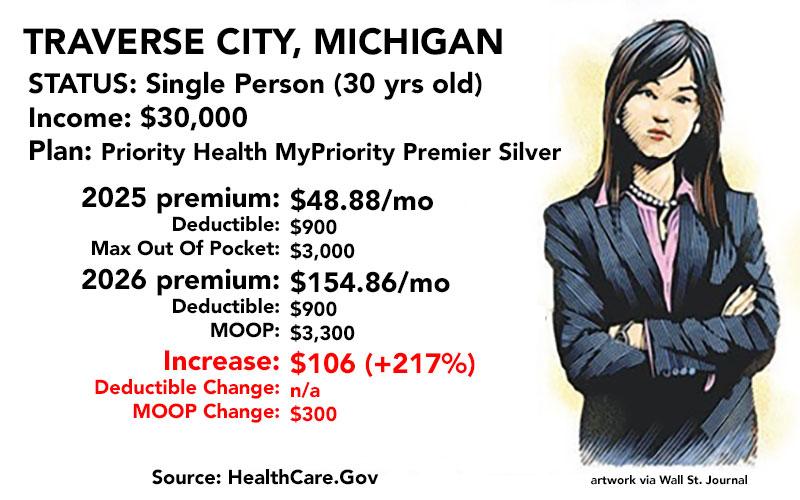

- A young adult living in Traverse City earning $30K/year

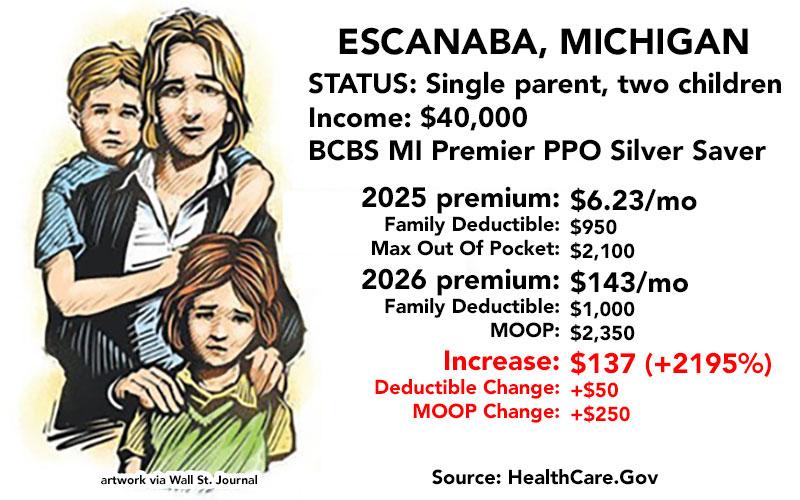

- A single mother with 2 young children living in Escanaba earning $40K/year

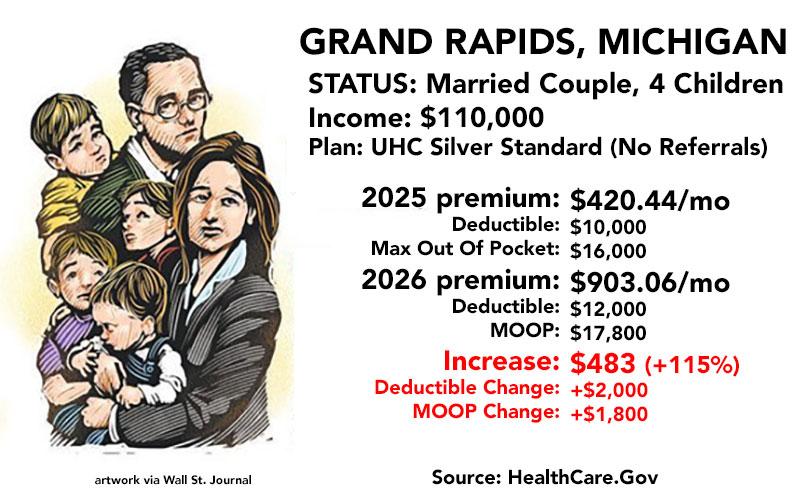

- A married couple with 4 children living in Grand Rapids earning $110K/year

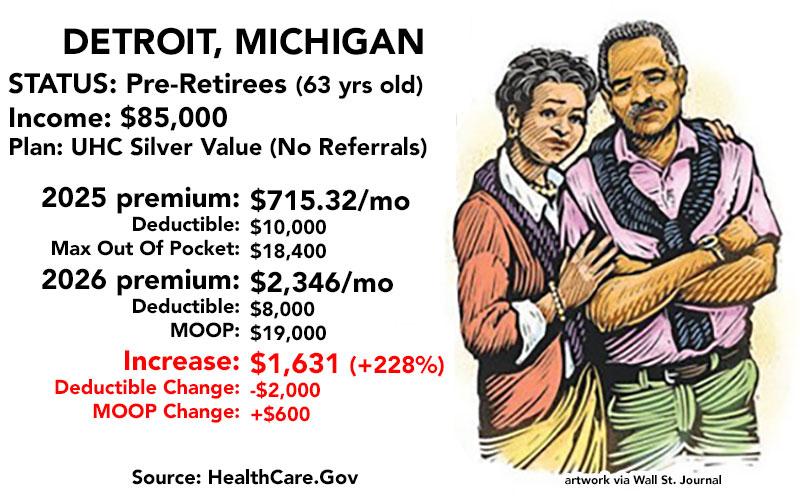

- An older couple just shy of Medicare age in Detroit earning $85K/year

In three of these cases I'm assuming they're enrolled in the benchmark Silver plan both years; for the older couple in Detroit I went with a different carrier since the 2025 benchmark plan is from Meridian, which is pulling out of the Metro Detroit area (for these examples I wanted to keep the actual plans identical both years to keep things simple).

Here's what they look like:

In her case, I'd strongly recommend sticking with a Silver plan to keep her Cost Sharing Reduction (CSR) assistance, so if she's willing to switch carriers, she could move to a Blue Cross Preferred HMO Silver Saver, which would reduce her premiums by $19/month ($230/year) while also reducing her MOOP by $1,100. Her deductible would go up by $200, though.

If she was really trying to keep the premium around the same as this year while sticking with Priority Health, however, the MyPriority Value Bronze HSA would go for $35/month (less than she's paying now)...but with a $7,500 deductible & MOOP since she'd be giving up the CSR savings (which are only available with Silver plans).

At $40K/year, her children are eligible for the Children's Health Insurance Program (CHIP), so we're just talking about providing coverage for the mother. Again, I'd strongly urge her to stick with a Silver plan for the CSR assistance.

This example has the most extreme premium hike in sheer percentage terms, because the mother is going from just $6/month to $143. If her chief concern is keeping the premium down, she could switch from the PPO to the HMO version of the same Silver Saver plan. this would only cost $14/month, and the deductible and MOOP would be in the same range as this year ($1,100 and $2,200 respectively).

The major drawback to doing this is that in addition to involving a lot more prior approval headaches, HMOs generally have smaller provider networks, which could be a serious problem in a small rural town like Escanaba (in Michigan’s Upper Peninsula).

In this case, the family isn't eligible for for any CSR help since they're slightly over the income threshold for that. If their top priority is keeping the same provider network (which I presume means staying with UnitedHealthcare), they could downgrade from Silver to the Bronze version of their current plan, which would run $465/mo (just $45 more per month)...but would also bump their deductible & family MOOP up to $15K and $20K respectively.

Finally, we have the older couple hoping to hold out for Medicare eligibility when they turn 65. They face by far the highest raw dollar premium hike, with their 2026 premiums alone eating up a whopping 33% of their gross income...and that's before the deductible (which, interestingly, drops by a couple thousand dollars) or their joint maximum out of pocket cap.

If sticking with their current carrier provider network is most important, they could drop down to the Bronze version of their UnitedHealthcare Value plan, which would knock the premiums down to $1,830/mo. This would "save" them $516/month (even though they'd still be paying over $1,100 more per month than they are now), but it would also kick their joint deductible & MOOP up to $15K & $20K respectively.

Alternately, if their chief concern is purely to have minimal major medical coverage and the carrier isn't important, the lowest-priced option would be a Blue Care Network Local HMO Bronze Secure plan for $1,611/month...with a maxxed-out $21,200 joint deductible/MOOP.

They'd still be paying nearly $900/month more than they are now (23% of their gross income), but at least they'd avoid bankruptcy in the event of a catastrophic medical disaster.

Speaking of which, there are actually a half-dozen Bronze plans which would cost this couple less than the lowest-priced Catastrophic plan on the market (which they weren't eligible for at all until now.

Catastrophic plans were only intended to be available to enrollees under 30 years old, but the Trump Regime is opening up eligibility to enrollees of any age as long as they aren't eligible for federal tax credits). As I warned back in September, however, this is hardly a panacea--as you can see here, once the carriers adjust Catastrophic plan pricing for older enrollees, most (or all) of that bare-bones cost advantage pretty much goes out the window.

In this couple's case, there are 2 Catastrophic plans available...the less-expensive of which would run them $1,890/month, which kind of defeats the point.

There are other options available for all of these examples; the point is that they should be sure to shop around for a (hopefully) better value.

I'll be posting more about HealthCare.Gov launching window shopping later today.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.