CBO: Clean 3-yr enhanced tax credit extension would result in 4M Americans gaining coverage while reducing *gross* premiums as well as net

This just out from the Congressional Budget Office (CBO) ahead of today's final House vote on a "clean" 3-year extension of the enhanced ACA tax credits:

H.R. 1834 would authorize an extension through 2028 of the premium tax credit structure provided in the American Rescue Plan Act of 2021 and later extended through calendar year 2025 by the 2022 reconciliation act. The advanceable and refundable premium tax credit reduces out−of-pocket costs for the premiums enrollees pay for health insurance obtained through the marketplaces established by the Affordable Care Act.

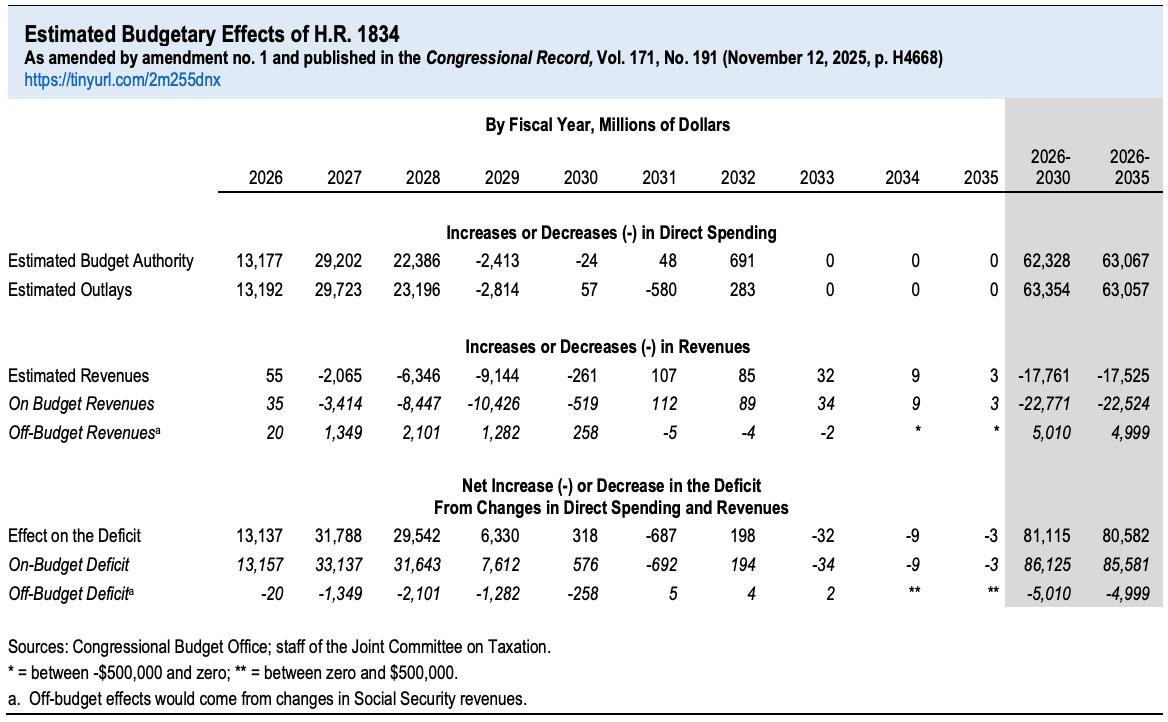

Budget-wise, the CBO is pegging a 3-yr extension at costing around $80.6 billion net (they had previously pegged a 10-yr extension at ~$350B, but that assumes 10 years of inflation/etc as well).

...For this estimate, CBO assumes that the bill will be enacted in January 2026.

CBO estimates that enacting H.R.1834 would increase the number of people with health insurance by 0.1 million in 2026, 3.0 million in 2027, 4.0 million in 2028, and 1.1 million in 2029, relative to current law. The 4.0 million increase in 2028 would result from changes in several types of coverage:

- 6.2 million more people would be enrolled through the health insurance marketplaces established by the Affordable Care Act,

- 0.4 million more people would be enrolled in Medicaid and the Children’s Health Insurance Program combined,

- 0.5 million fewer people would purchase nongroup coverage outside the marketplaces, and

- 2.1 million fewer people would have employment-based coverage

"Nongroup coverage outside the marketplaces" is a polite way of referring to junk plans (so-called "short-term plans," "sharing ministry plans," "indemnity plans" etc.)

The 2.1 million who would shift from employer-based to ACA coverage would mostly be people freed up from "job lock" (ie, those who are stuck at a job they hate--or were forced to take one--because they need it for the insurance benefits).

The ~400K gaining Medicaid/CHIP coverage is interesting as well. The CBO report doesn't go into any detail on why this would be the case, but I would imagine it's because when people apply for ACA exchange coverage and enter their household details (including household income), HealthCare.Gov and/or the state-based exchanges will automatically route them towards Medicaid or CHIP coverage instead if their income indicates that they're eligible for it.

The estimated increase in the number of people with health insurance relative to the number under current law is smaller for 2026 than for 2027 or 2028. That smaller number for 2026 reflects CBO’s expectation that people who are shopping for insurance would not see net premiums that incorporate the expanded credit structure before the close of the annual enrollment period for the 2026 plan year (the net premium is the amount of the premium after accounting for the tax credit). However, CBO projects some additional enrollment through existing special enrollment periods over the remainder of the year.

It's important to note that the exact language of H.R. 1834 doesn't actually include an extension of the deadline for the 2026 Open Enrollment Period, although my guess is that if there is any actual extension which becomes law, the final version would bump the final deadline out for perhaps another month or so (which is what happened back in 2021 when the American Rescue Plan Act wasn't passed until March to begin with).

CBO also estimates that in 2026, gross premiums for benchmark plans in the marketplaces would be unchanged relative to current law, but that they would be lower by 5.7 percent, 9.0 percent, and 3.3 percent in 2027, 2028, and 2029, respectively, relative to baseline projections. (Gross premiums reflect the amount before a tax credit is applied.)

"Relative to baseline projections" is an important caveat, since there are a bunch of other factors which always push gross premiums up or down, including general inflation, utilization rates, coverage of new prescription drugs, regulatory changes, changes in state taxes, etc. So premiums for plans from a given carrier might only go up, say, 2% from 2027 to 2028 when they otherwise would have gone up 11%, for instance.

The estimated decline for benchmark premiums arises from the expectation that, on average, the people who enroll in the marketplaces would be healthier than would be the case without the extension. Gross premiums for the 2026 plan year are unchanged in CBO’s current estimates because those premiums have already been set for the 2026 plan year.

This estimate reflects CBO’s expectation that some effects on enrollment and premiums would persist beyond the availability of the expanded credit.