Murphysboro: How $1 can cost you $65,000...or get you a Gold PPO for $11/month

For nearly a year now I've been shouting from the rooftops about the eye-popping net premium hikes which millions of ACA enrollees are going to see starting one month from today, assuming the enhanced Advanced Premium Tax Credits (eAPTC) which have been in place for the past five years are allowed to expire on New Year's Eve.

I've put together 51 bar graphs showing examples of what these net premium increases will look like for various households at different income levels in every state. Since there's so many variables from state to state including different Rating Areas, different levels of carrier participation, different provider networks and different benchmark Silver plans from county to county (and even from zip code to zip code), I decided to use the capital city of each state as my rule of thumb.

For the households, I went with four case studies: A single 50-yr old adult w/no dependents; a 30-yr old single parent with one child; a "nuclear family" (40-yr old couple with two kids age 15 & 12); and a pre-retiree couple (64 yrs old, just shy of Medicare eligibility age).

In doing so, I found a wide range of results, especially for families earning just over 400% of the Federal Poverty Level, since anyone earning more than that next year will have eligibility for any ACA tax credits cut off immediately (again, assuming the enhanced credits aren't extended at the last minute).

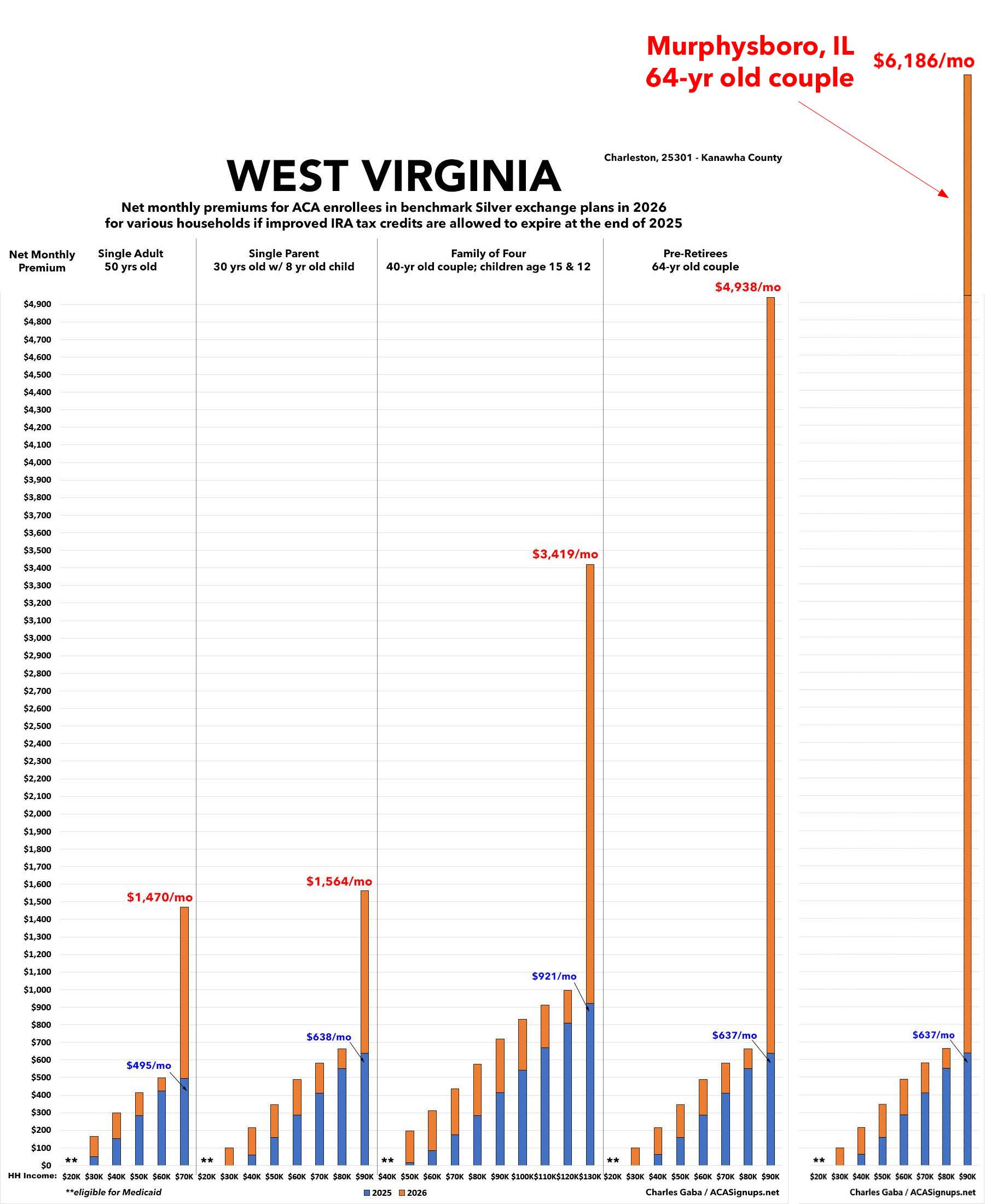

In putting together this project, the most extreme net rate hike example I was able to find was in Charleston, West Virginia, where a 64-yr old couple earning $90,000/year (426% FPL) would go from having to pay $637/month for the benchmark Silver plan in 2025 (8.5% of their gross income) to a whopping $4,938/month starting January 1st.

That's a 7.8x theoretical price increase literally overnight, or over $59,000/year in premiums alone...which would also cost nearly 2/3 of their gross income next year. Obviously no one would ever be able to actually pay that much, of course, which is why there will never be an actual case of this happening.

Any such couple would downgrade to the dirt-cheapest Bronze or Catastrophic plan...although even that's not really an option for them, since even the least-expensive Catastrophic plan would still cost over $2,800/month, or 38% of their gross income. Instead, they'd almost certainly have to drop coverage entirely, which isn't a great idea for anyone in their 60's either. Basically, they'd be screwed.

After completing my state-by-state project, I decided to poke around a bit more to see if I could find an even more extreme example...and I was able to do so using a different region of West Virginia, which has 11 Rating Areas.

Area 5 (which includes Cabell, Mason, Putnam & Wayne Counties) is the most expensive. If I enter the 64-yr old couple example into Cabell County and assume their 2026 annual income is just barely over 400% FPL ($84,601), they go from paying $599/month for the benchmark Silver plan in 2025 to a stunning $5,514/month next year.

That would be over 9.2x as much as they're paying now, and would add up to over 78% of their gross income.

HOWEVER, it turns out there's another part of the country where this hypothetical 64-yr old couple would face an even more insane rate hike...and it's in a state you'd likely never expect: Illinois.

Try this yourself:

- Visit GetCovered Illinois (their just-launched state-based ACA exchange).

- Enter 62966 as the zip code (Jackson County, IL).

- Enter 01/01/1962 as the primary applicant's birthdate

- Select "add spouse" and enter 01/01/1962 as the spouse's birthdate as well

- Under Annual Tax Household Income, enter exactly $84,600 (this is exactly 400% FPL for a 2-person household in 2026)

On the next screen, you'll see:

Lower monthly premium

Estimated Tax Credit of $5472 /month

Based on the income you entered, you may qualify for an Advanced Premium Tax Credit (APTC). A tax credit could lower your monthly insurance bill.

$5,472/month x 12 months equals $65,664 in eAPTC for this couple if it was to be extended until the end of 2026.

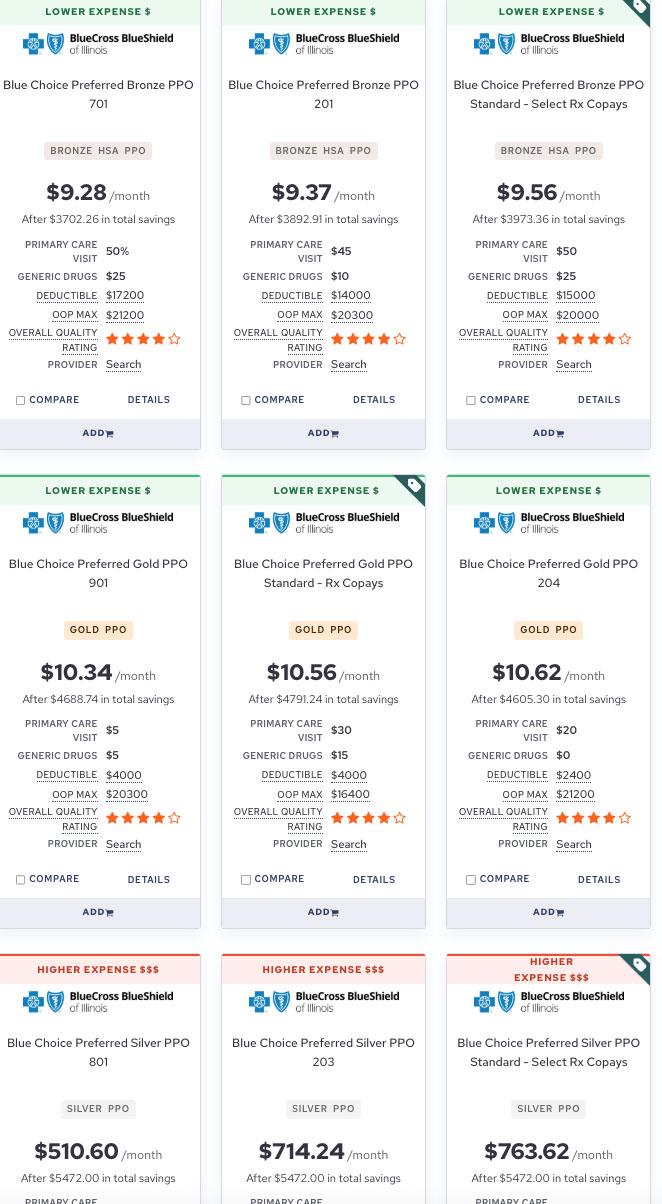

From there, if you continue on to window shop for plans, you'll find a pretty limited selections (just 9 plans) with net premiums ranging from a dirt-cheap $9.28/month to a still-quite reasonable $763.62/month at most (10.8% of their income).

You'll also likely note that all 9 are from a single carrier (Blue Cross Blue Shield of IL) as well as that all 3 of the Gold plans cost less than $11/month while the three Silver plans cost between $500 - $764/mo.

I'll come back to both of these points below.

Next, click on "Edit Family Info" at the top of the page and make one small change: Increase the Annual Tax Household Income by just $1.00, to $84,601.

Since the annual 2026 household income is now slightly more than 400% FPL for 2 people, on the next screen you'll see:

Tax credits: No. Quality options: Yes.

While you do not qualify for the premium tax credit, you may still be able to get access to Qualified Health Plans.

In Jackson County, Illinois, you can get plans for about $5971 /month

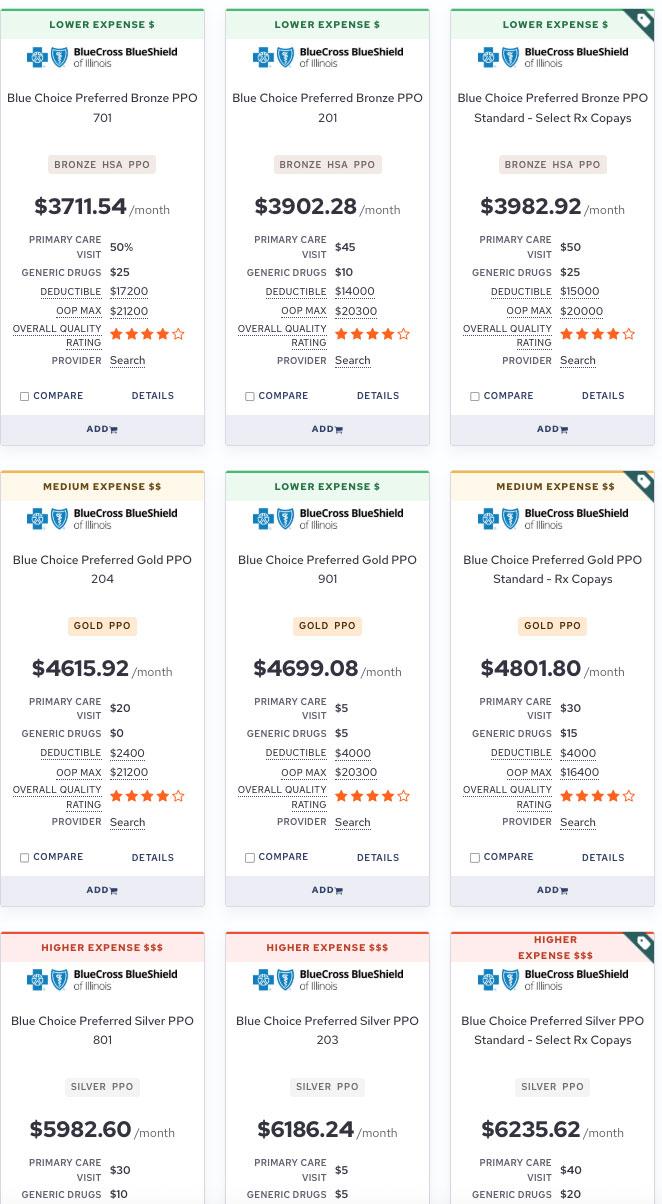

When you skip past the next few screens to see the actual plan options, you'll see the same nine plans from BCBSIL (3 Bronze, 3 Silver, 3 Gold)...except that now they're all listed at full price...which ranges from $3,712/month for the least-expensive Bronze to an absolutely eye-popping $6,236/month for the most-expensive Silver plan.

The benchmark Silver (the 2nd least-expensive of the three) now costs $6,186/month.

That's $74,234.88/year, which would theoretically be nearly 88% of this couple's gross income...and that's doesn't even include the $3,000 deductible or $21,200 maximum out of pocket ceiling for in-network care.

In other words, if this particular couple living in this particular area happens to earn just one dollar more than the 400% FPL cut-off, they'll lose over $65,000 in federal financial assistance while simultaneously being unable to afford even the least-expensive Bronze plan, which would still cost OVER HALF THEIR GROSS INCOME.

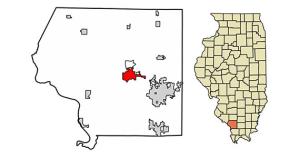

Zip code 62966 is located in Murphysboro, IL, which is the county seat of Jackson County. It also happens to be in the middle of Illinois' 12th Congressional District, which includes the southern portion of the state.

The U.S. Representative for IL-12 is a Republican named Mike Bost. Now, Bost is in no danger of losing his seat, which he won by nearly 50 points last year while Donald Trump carried it by 43 points. Furthermore, "only" around 27,000 of his constituents are enrolled in ACA exchange coverage today (roughly 3.6% of the total population), so Rep. Bost probably isn't losing much sleep over the issue.

A hell of a lot of his colleagues should be, however.

As an aside, you may be wondering how Illinois--which doesn't even in the top 10 most expensive average ACA premiums next year--can have higher unsubsidized benchmark Silver premiums than West Virginia, which ranks #1 on that list with average premiums over 50% higher than Illinois statewide.

There's a couple of reasons for this. First, again, you have to remember that even the overall plan averages are statewide, which range widely depending on what part of the state you're talking about (again, WV has 11 Rating Areas; IL has 13).

Second, remember, we're talking about the benchmark plan specifically...which can also range widely even within the same rating area depending on which insurance carriers are participating in that particular county (Jackson County is located in IL Rating Area 13, which includes 26 other counties).

Third--and this one is critical in this particular case--remember that Jackson County (or at least Murphysboro) only has a single insurance carrier participating in the ACA marketplace. This surprised me at first, since Illinois generally has fairly robust individual market competition; they had 11 different carriers participating on the exchange last year.

HOWEVER, not only is that changing dramatically starting in January--four carriers are dropping out, including two divisions of Aetna, Health Alliance Medical Plans and Quartz--but you also have to remember that even the remaining seven carriers aren't offering plans everywhere in the state.

Since BCBSIL is the only game in town in Murphysboro, that means that they pretty much decide how much the benchmark plan will be priced at.

(As an aside, my friend & colleague Dave Anderson actually posted about this situation and the odd pricing choices being made by BCBSIL from a more carrier-centric perspective).

But wait, there's more! The flip side of this example is equally interesting:

If the same couple is able to keep their 2026 Modified Adjusted Gross Income (MAGI) below 400% FPL (either due to their regular income or thanks to putting money into an IRA and/or HSA), they'll be eligible for a Gold PPO plan with a mere $2,400 deductible for less than $11/month!!

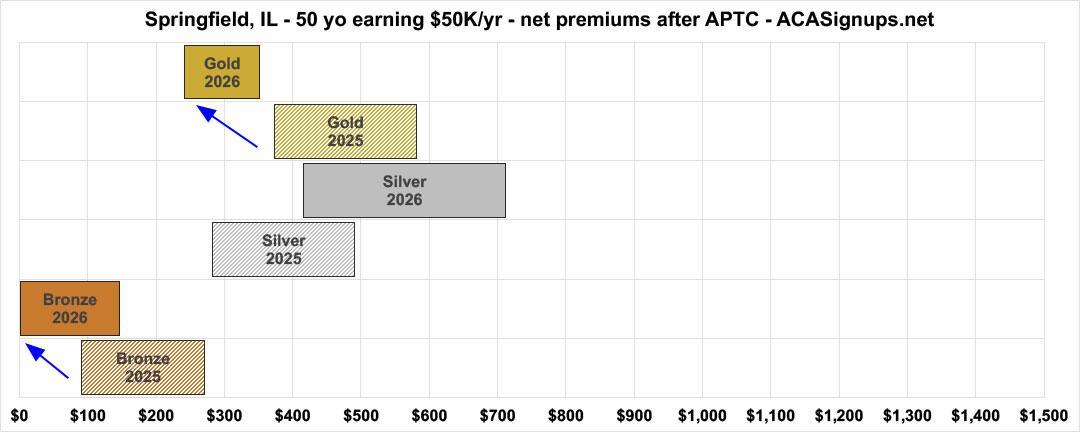

The reason for THIS head-scratcher (the most expensive GOLD costing just $11/mo while the least expensive SILVER costs $511/mo, or 48x as much!) is once again thanks to the "magic" (it's not, it's just actuarial math) of robust Premium Alignment pricing policy.

As I noted a couple of weeks ago, this is what Bronze, Silver and Gold plans are priced at for a single 50-yr old earning $50K/yr at full price in 2026 vs. 2025. At the time I noted how, thanks to Illinois newly-implementing Premium Alignment, Gold plans go from costing slightly more than Silver on average in 2025 to costing significantly LESS than Silver in 2026 even at full price.

That alone makes Gold plans a much better value for anyone not subsidized next year...but when you add subsidies to the mix, it becomes even more dramatic.

The reason for this is that, again, the amount of tax credits--whether enhanced or not--you're eligible for is based on whatever the full price premium of the benchmark Silver plan happens to be that year. Since Silver plan pricing increased dramatically, so does the APTC for anyone below 400% FPL...but since you can apply APTC towards Bronze, Gold or Platinum plans (where available) as well, that means this couple (if under 400%) gets savings on top of savings by choosing Gold: It's much less expensive to begin with, plus the tax credits have been maximized for their benefit on top of that.

In fact, if you look closely, you'll see that Gold plans are priced so low that they can't even apply the full APTC towards them: The most-expensive Gold plan would cost $4,802/mo at full price. Since the ACA doesn't allow the net premium for any policy to fall below $0 for obvious reasons, this means that there's around $670/month in tax credits which can't be used because there's simply nowhere for it to go.

(As an aside: If you're wondering why all of the "fully subsidized" plans still cost between $9.28 - $10.62/month, that's because they include some additional services which the ACA doesn't legally allow to be covered by federal tax credits: Coverage of abortion, for example, as well as other oddball services not considered Essential Health Benefits under the ACA itself which may be required by the state).

P.S. For what it's worth, here's what the benchmark Silver bars look like for the 64-yr old couple in Murphysboro, IL compared to the West Virginia graph (one slight difference: This assumes they earn $90K/yr in the lasts bar rather than $84,601, although that wouldn't have any impact on the unsubsidized price):

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.