38 under 15: ACA enrollment & looming premium hikes for every vulnerable GOP House member

There are 43 U.S. House districts where the Republican nominee won by 15 points or less. Of those, one (WA-04) doesn't really count since there were 2 Republicans running in the general election (Washington State has "jungle primaries"). Four others were won by Donald Trump by between 16 - 20 points (AZ-08, CO-04, TX-15 & WI-08).

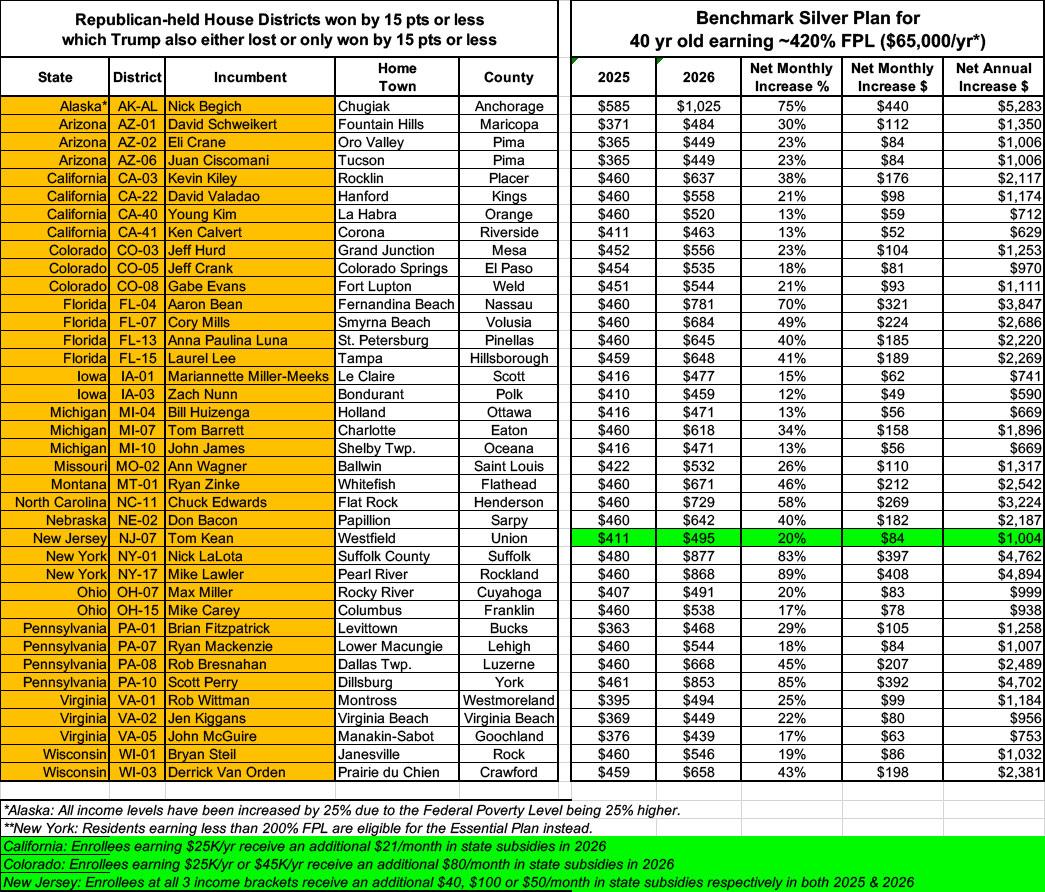

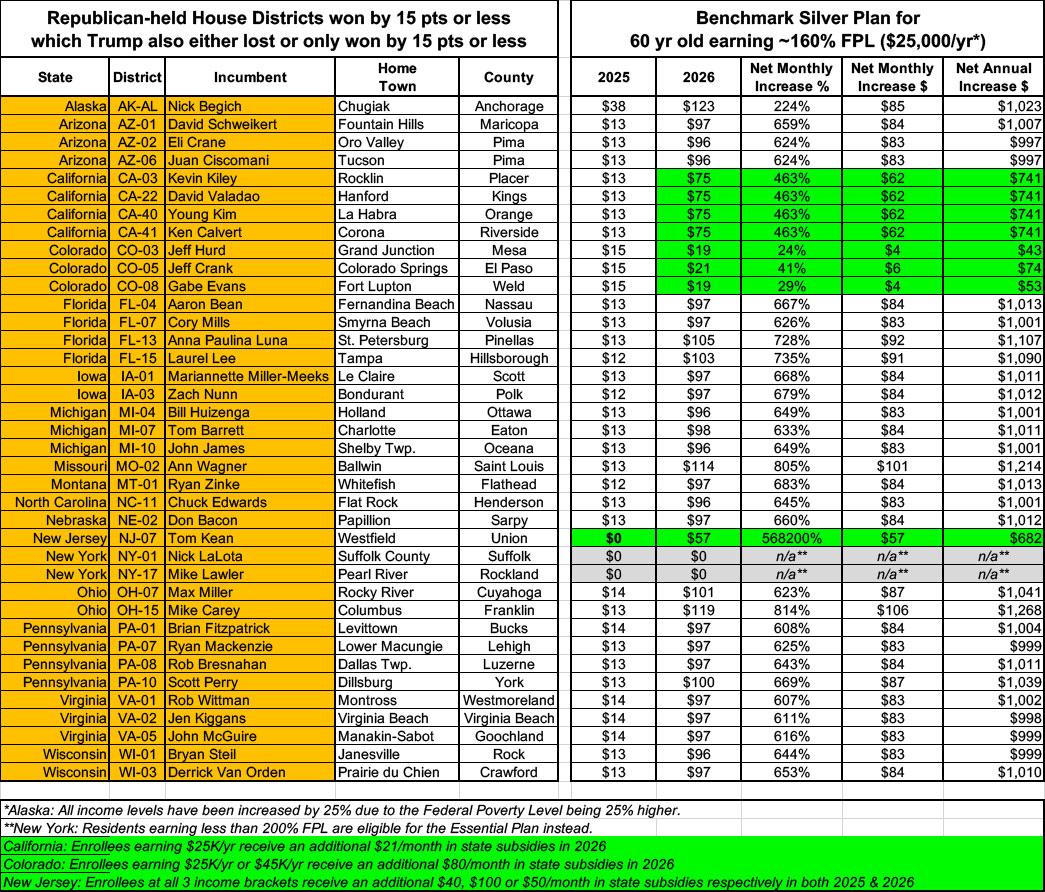

That leaves 38 GOP-held House seats where the Republican won by 15 pts or less and where either Kamala Harris won, or Donald Trump also won by 15 points or less. The table below breaks these out with both margins, while also listing my estimate of how many residents of each district are enrolled in ACA coverage.

(h/t Ballotpedia & The DownBallot)

There's a couple of important caveats to keep in mind here:

- The New York districts have fairly small numbers of ACA enrollees; this is because of NY's Basic Health Plan program (the Essential Plan), which enrolls over 71,000 residents in NY-01 and over 39,000 in NY-17.

- All 38 districts are based on the 2024 maps. This is important since multiple states either have already redrawn their Congressional maps for the 2026 midterms, including California, North Carolina, Ohio, Texas & Utah, or are in the process of attempting to do so, including Florida, Indiana, Missouri & Virginia. In other words, nearly half of the districts below may not be relevant to this analysis by next November.

- Several of the incumbent Republicans below won't be running for re-election next year anyway, including NE-02 (Don Bacon, retiring); AZ-01 (David Schweikert, running for Governor); & MI-10 (John James, running for Governor).

Having said all of this, here's the districts in question:

For this project, I was inspired by KFF's recent analysis which looked at how much benchmark Silver plan premiums will go up starting on January 1st in every House district for people earning exactly 401% or 701% of the Federal Poverty Level (FPL).

However, I wasn't satisfied with this because only around 14% of ACA exchange enrollees earn more than 400% FPL (and only ~8% earn more than 700% FPL). I wanted to include the impact on more typical enrollees as well.

Therefore, I embarked on an ambitious project: I used the home town of every House member above to plug in case studies for a single 40-yr old or a single 60-yr old adult earning either $25,000/year, $45,000/year or $65,000/year.

I chose these income levels as they cover a pretty good range of enrollment:

- $25,000/yr is 166% FPL in 2025 and 160% FPL in 2026

- $45,000/yr is 299% FPL in 2025 and 288% FPL in 2026

- $65,000/yr is 432% FPL in 2025 and 415% FPL in 2026

Note: Since the Federal Poverty Level is 25% higher in Alaska, I had to bump up the incomes for AK-AL to $31,250, $56,250 and $81,250 respectively.

There's also a few other caveats to keep in mind:

- New York: As noted above, New York has a Basic Health Program (BHP) for residents who earn less than 250% FPL in 2025 (this is dropping to 200% FPL starting January 1st). As a result, the $25K examples aren't applicable for either 40 or 60-yr old enrollees.

- California is backfilling all lost federal tax credits for enrollees who earn up to 150% FPL (not shown), and modest state subsidies for those who earn 150 - 165% FPL only.

- Colorado is similarly providing an additional flat $80/month in state subsidies for primary policyholders who earn up to 400% FPL in 2026.

- New Jersey is continuing to provide flat monthly supplemental subsidies next year as well: $20/mo up to 150% FPL; $40/mo from 150 - 200% FPL; $50/mo from 200 - 250% FPL; $100/mo from 250 - 400% FPL; and $50/mo from 400 - 500% FPL.

- All states: Again, I'm assuming they're in the benchmark Silver plan both years, which means I'm not taking into account the prospect of Silver Loading or Premium Alignment which I've written about before extensively. I may revisit this soon, but for now I'm trying to keep it simple.

I've color-coded all of the above in the tables below: Grey for New York's BHP program, green for the extra state subsidies in CA, CO & NJ.

OK, got all that? Let's take a look!

I'm gonna start this off with a 40-yr old earning $25,000/year.

Right off the bat you can see that premiums are skyrocketing by anywhere from 26% to a mind-boggling 567,300% depending on the district (technically NJ-07 premiums are increasing by an infinite amount since the enrollee is literally paying $0/month right now, but I changed this to $0.01/mo in order for there to be an actual percent shown in the other cell instead of #DIV/0!).

Both of these are outliers, however thanks to the state-based subsidies: Without them, NJ-07 would go from the same ~$13/mo shown in most of the other districts (around 0.6% of their gross income) to $97/mo, while the Colorado examples would show similar increases. The same is true in California, where enrollees earning ~160% FPL will receive a modest $21/month state subsidy.

The reason for other slight variances are mostly because many ACA exchange plans include additional small services which aren't considered to be Essential Health Benefits (EHBs) and therefore can't be covered via federal subsidies. These can tack on an extra few dollars/month to the net premiums, and include things like coverage of abortion (mandatory in some states, prohibited in others) and adult dental and/or vision coverage.

At $25,000/year income, without the extra subsidies being provided in a few states, a 40-yr old is generally looking at their net premiums jumping by around 600 - 700% starting less than a month from today...or upwards of an extra $1,000/yr...again, on a gross income of just $25,000.

Next up: The same 40 yr old if they earn $45,000/year:

In this case there's a lot fewer outliers, since we're above the BHP income threshold in New York and above the state subsidy cut-off in California.

In most districts, these enrollees will go from paying around $222/month to around $360/month...roughly a 62% net premium hike. While this isn't nearly as dramatic as the 600-700% increases above, that's still a massive cost spike for someone earning a fairly modest income. It amounts to over $1,600/year added to their cost of living.

Again, notice how the Colorado district premiums still increase by over 25% even with the extra $80/month provided by the state. Any other year, a 25% increase in your health insurance premiums would be considered a disaster; in the current situation it's considered a relief.

Next up: A 40 yr old who earns $65,000/year:

We're now over the 400% FPL federal tax credit cut-off threshold, otherwise known as the Subsidy Cliff. Interestingly, the actual dollar amount increases are considerably smaller for enrollees in some districts than they were at the lower levels...but much higher in others.

The increase ranges from "only" $49/month in IA-03 (Zach Nunn) to a whopping $440/month in AK-AL (Nick Begich). That's anywhere from between $588 to over $5,000/yr more that these enrollees will have to pay next year. In percentage increases it ranges from a (relatively) "modest" 12% to an ugly 89% increase depending on the district.

OK, now it's time to move on to the 60-yr old, at the same income levels.

(Side note: New York is one of two states--the other is Vermont--which has no age band, meaning that the 40 & 60-yr olds pay the same amount for the same plan).

First up: A 60-yr old who earns just $25,000/year (again, $31,250 for AK-AL):

The main thing to notice here is that for the most part the net premiums for both years are either identical or very close to what they look like for the 40-yr old at the same income level. This is because while gross premiums can be up to 3x higher for older enrollees than younger ones in nearly every state, net premiums are mainly determined by the federal Advanced Premium Tax Credit (APTC) formula, which is based on income. Since the income in this table is the same $25,000/yr as for the 40-yr old enrollee, everything else is nearly the same as well.

Regardless, a 60-yr old earning only $25K/yr can't really afford to pay an extra $1,000/yr in premiums any more than a 40-yr old can...and the 60-yr old is a lot more likely to have medical problems as well.

Next up: A 60-yr old who earns $45,000/year:

Again, notice how the 2025 and 2026 net premiums are pretty much identical to what they look like for the 40-yr old at the same income level. In most cases these older enrollees are still looking at ~61% rate increases, or over $1,600/year more for the same plans.

FINALLY, here's a 60-yr old who earns $65,000/year...around 420% FPL, or just over the Subsidy Cliff:

HOLY CRAP.

While the $25K examples have by far the highest percentage net premium increases, in terms of raw dollar figures it's those just a hair over the Subsidy Cliff who are facing the most jaw-dropping rate hikes.

In NY-01 (Nick LaLota), a 60-yr old enrollee will go from paying just $480 to $877/month...an 83% rate hike. And that's the least-dramatic example.

In most districts, their premiums will increase from $460/month to well over $1,000/month...over $1,800/month in PA-10 (Scott Perry). The average rate increase across these 38 districts will be 159%...over 2.5x as much as they're paying today.

On an annual basis, we're talking about an additional $4,700/yr at the low end to an insane ~$19,000/yr in premium hikes in Alaska (Nick Begich).

Do with this information what you will.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.