Rebutting Sen. Lankford's Disingenuous CNN Appearance: Part 1 of 2

Yesterday morning on CNN's "State of the Union," host Kasie Hunt talked to Oklahoma GOP Sen. James Lankford about the enhanced ACA tax credits which are currently scheduled to expire exactly 10 days from now.

This gets into the weeds a bit, so I'm breaking it into two separate posts; I'll be publishing the second part tomorrow.

The crux of the CNN appearance was Langford claiming that "Obamacare" (the Affordable Care Act...guys, he's been out of office for nearly 9 years now, let it go willya?) "caused prices to skyrocket in the marketplace" and that the expiration of the enhanced tax credits put into place in 2021 during the COVID pandemic is simply "exposing the real issues" within the ACA.

First of all, let's clear up this "they were only put in place due to the COVID pandemic" talking point which Republicans keep tossing around (the implication being that since the COVID pandemic is over, the subsidy upgrade should end as well).

Get it straight: Eliminating the 400% FPL subsidy cliff and beefing up the tax credit formula is something which Democrats always intended to do when they had the ability to do so.

The original tax credit formula of the ACA was always seriously underfunded; that formula was simply the best that Democrats in the 2009-2010 Congress were able to get through at the time. The intent was always to make them more generous down the road, with good reason.

As evidence of this, I give you H.R. 1868, the Health Care Affordability Act of 2019. HR 1868, which I wrote about extensively at the time, improved the ACA tax credits in almost exactly the same manner as what was eventually passed as part of the American Rescue Plan Act in 2021.

HR 1868 eliminated the 400% FPL "subsidy cliff" cut-off and made the underlying formula much more generous...and it was included as part of a larger bill, H.R. 1884, the Protecting Pre-Existing Conditions & Making Healthcare More Affordable ACT of 2019, which had 162 cosponsors in the House.

Need further evidence? Look no further than the healthcare policy platforms of various Democratic Presidential candidates during the 2020 primary season:

- Elisabeth Warren: Her bill, S. 1213, the Consumer Health Insurance Protection Act of 2019, would have removed the 400% FPL subsidy cliff and beefed up the underlying subsidies so that no one would spend more than 8.5% of their income on the benchmark Silver plan (ie, the exact same formula as HR 1868 and HR 1884).

- Pete Buttigieg: His platform included capping premium payments at 8.5% of income for everyone (ie, also eliminating the subsidy cliff).

- Joe Biden: Yes, the future President included as part of his official healthcare platform a proposal to eliminate the subsidy cliff and cap silver plan coverage premiums at no more than 8.5% of household income.

Hell, I even put together a table which broke out which healthcare policy reforms each candidate supported, and all 8 of the major Democratic candidates (which also included Kamala Harris, Cory Booker, Julian Castro and Amy Klobuchar) were onboard with the exact same improvement to the tax credit formula, complete with the 8.5% upper cap.

Again: All of this happened a full year before the COVID pandemic and two years before the enhanced tax credits were eventually passed & signed into law in March 2021.

The fact that it was done as part of a COVID spending package was coincidental but also made perfect sense timing-wise, seeing how providing affordable healthcare was obviously an even more critical issue at the time.

They always intended it to be permanent...as it should be, since the improved formula simply brings the ACA subsidy levels up to where they should have been in the first place.

Unfortunately they were still only able to get then-Democratic Senator Joe Manchin to agree to do so for two years initially, and, later, for another three years as part of the Inflation Reduction Act...and that's the expiration date which is coming up just 10 days from now.

(FWIW, even Manchin had earlier stated that he was open to making the enhanced tax credits permanent as long as they were means tested...which, of course, they already are. He later reversed himself, however, which is why they were only bumped out another 3 years as part of the Inflation Reduction Act.)

As an aside: There was another pretty important health insurance policy which originally started out as a temporary measure put into place during a national emergency but which remained the norm nationally for decades after that: Employer-Based Insurance itself:

World War II gave birth to the private health care market. In 1942, Congress passed the Stabilization Act of 1942 freezing wages and salaries for workers. In order for companies to continue to recruit and pay employees, Employers started providing Employer paid health care. Prior to this, individuals paid for their own medical care in cash.

Sure enough, even the U.S. Chamber of Commerce confirms this:

When the program began, it was designed to help retain and attract workers in the aftermath of World War II. Employers were incentivized to provide health insurance benefits to employees, and many did. Since the 1950s, Treasury regulations have affirmed that amounts paid by an employer to cover health insurance premiums for its employees are generally deductible as ordinary and necessary business expenses, reducing the cost of providing this critical benefit to workers and their families. By reaffirming that employer-provided coverage would maintain its tax-favored treatment for employers, the system quickly became the backbone of American health insurance.

In any event, next, Lankford claims that...

"...And what happened when Obamacare was put in place? Prices skyrocketed in the marketplace during COVID. Democrats put an additional subsidy on top of the Obamacare subsidies."

This is simply factually false: Here's how average unsubsidized (ie, full price) premiums have changed over time since 2017, with the COVID years highlighted:

- 2017: $476/mo

- 2018: $621/mo (+30.5%)

- 2019: $612/mo (-1.4%)

- 2020: $595/mo (-2.8%)

- 2021: $590/mo (-0.8%)

- 2022: $594/mo (+0.7%)

- 2023: $605/mo (+1.9%)

- 2024: $605/mo (FLAT)

- 2025: $619/mo (+2.3%)

- 2026: $777/mo (+25.5%)

That's right: ACA premiums actually dropped on average in 2020 and 2021, went up by less than 1% in 2022 and by less than 2% in 2023. In fact, they actually dropped just a hair from 2018 to 2025!

In the years above, there are only two which show significant rate hikes: 2018 (mostly caused by CSR costs being shifted from direct reimbursement payments to being baked into the premiums directly)...and, of course, the upcoming spike in 2026 (4 percentage points of which is being caused by...that's right, the enhanced premiums expiring alone).

If Lankford had simply said that individual market premiums have gone up dramatically since 2013 (the last year before ACA regulations kicked in), he would have been on much safer ground. So why did he throw in that "...during COVID" bit? Because he's trying to link the premium hikes to the enhanced subsidies specifically, even though there's absolutely zero evidence of that (and in fact if anything the data shows the exact opposite).

Lankford then says that...

"...Just in my state [Oklahoma] we took a six-year snapshot. The Obamacare marketplaces went up 198% during that time period. Normal insurance, commercial insurance for everybody else went up 29% during that time period."

"Normal" insurance (WTF?) appears to refer to employer-sponsored insurance for "everybody else" (which can't be what he meant since "everybody else" would include everyone on Medicare, Medicaid & the VA as well).

I took a look at the same KFF data and found the following average ACA marketplace premiums for Oklahoma specifically:

- 2017: $620

- 2018: $699 (+12.7%)

- 2019: $674 (-3.6%)

- 2020: $644 (-4.5%)

- 2021: $623 (-3.3%)

- 2022: $623 (FLAT)

- 2023: $647 (+3.9%)

- 2024: $632 (-2.3%)

- 2025: $616 (-2.5%)

- 2026: $775 (+25.9%)

Of course, Lankford doesn't specify which six-year period he's talking about, but Oklahoma premiums went up just 4.4% from 2017 - 2023, and even if you include the dramatic 25.9% hike coming up in 2026 it would only be 20.3% from 2020 - 2026.

Notice how both of these are less than the 29% he claims that employer-based insurance went up over "the same" 6-year period.

For the record, even if you include the entire stretch from 2017 to 2026--which includes both "massive spike" years--Oklahoma rates still only went up 25%.

So where did Lankford get that "up 198% over 6 years" (ie, tripling) claim?

Well, for that to be accurate, the 6-year period in question would have to go back to 2013 (the last year before the ACA individual market requirements went into effect). Since average premiums in Oklahoma in 2019 were $674/month, this would put them at around $225/mo in 2013, which is certainly possible.

I'll come back to that in a minute.

Hunt then airs a clip of Alaska GOP Senator Lisa Murkowski warning of the political consequences of Republicans not extending the enhanced tax credits and asks Lankford a pretty obvious question: Why not at least kick the can down the road by a year or so to tide the 24 million ACA enrollees over for now while working out the specific changes to the ACA that Republicans want long term?

Lankford's response is utter horseshit:

"We actually have done that. Uh we voted uh in the Senate two different sets of proposals. Uh Democrats said, "Let's just extend the current subsidies three more years, no reforms, no changes. They wanted to have unlimited caps that literally any amount of income could get Obamacare subsidies on on top of it. You could get half a million dollars a year of income and get Obamacare subsidies."

...They wanted all the money to go straight to insurance companies in these tax credits that they want to give to insurance companies. We said that's caused major problems and all kinds of fraud that we could show all the fraud on it."

This is complete nonsense. It's true that the bill Senate Democrats brought to the floor was a "clean" 3-year extension of the current subsidy formula, but they were absolutely willing to work with Senate Republicans on a compromise which would have included both a cap on the upper income of subsidy eligibility as well as a crackdown on broker fraud in the marketplace.

Here's Dem Senator Jeanne Shaheen, who has simultaneously been one of the strongest advocates of making the enhanced subsidy formula permanent but who was also one of the 8 members of the Senate Dem caucus to vote to re-open the federal government:

Sen. Jeanne Shaheen (D-N.H.) is open to income caps on Affordable Care Act premium tax credits and looking into potential "fraud" in the program that's set to expire at the end of the year, she told reporters on Monday.

..."A cap on income and who can benefit from the premium tax credits? I mean, that's legitimate. 94% of people earn $200,000 or less. We ought to be able to cap it at that," she said.

"They want to address fraud and abuse measures," she said. "I think we're all opposed to having people benefit if they shouldn't, and to getting fraud out of the system."

And of course I've already the half-dozen or so House bills which had some level of bipartisan support, including the HOPE Act (my choice), the Common Ground bill and the Fitzpatrick bill (which was supposed to be given a vote in the House last week, but never was).

So, did the bill offered up by Senate Republicans actually include an extension of the enhanced premium tax credits with the income caps and crackdown on fraud?

Nope. Instead they offered a big pile of garbage which didn't include extending the premium tax credits at all.

This brings us to the key exchange in Lankford's appearance. He claimed that...

"I would tell you uh healthcare in 2010 before Obamacare kicked in. Healthcare in 2010 the normal premium was $215. $215. Now take what it is now after Obamacare has been put in place and I think the..."

..at which point Hunt, to her credit, interrupted him and stated the most important caveat possible:

"...Right, but insurance companies could could refuse to cover you for a pre-existing condition. I mean the health care system was vastly different before Obamacare for for many of those reasons.

I can not overstate how crucially important this clarification is.

As I (and others) have written about many, many times, prior to the ACA, individual market insurance carriers got to cherry-pick their enrollees, which meant that they didn't have to provide coverage to anyone they felt would be expensive to treat AT ALL.

It was unbelievably easy for insurance carriers to keep premiums low when they were allowed to only provide coverage to healthy people who they knew were unlikely to ever rack up significant medical claims...especially when they could also simply terminate coverage retroactively for anyone who did get diagnosed with a serious disease or suffer expensive injuries in an accident.

The second part of my blog entry (to be posted tomorrow) will focus entirely on Hunt's simple statement of fact: The health insurance landscape prior to the ACA was a completely different animal.

For now, however, I want to go back to that $215 figure Lankford claims as the "normal" premium (by which I assume he means "average"). Where did he get this specific figure?

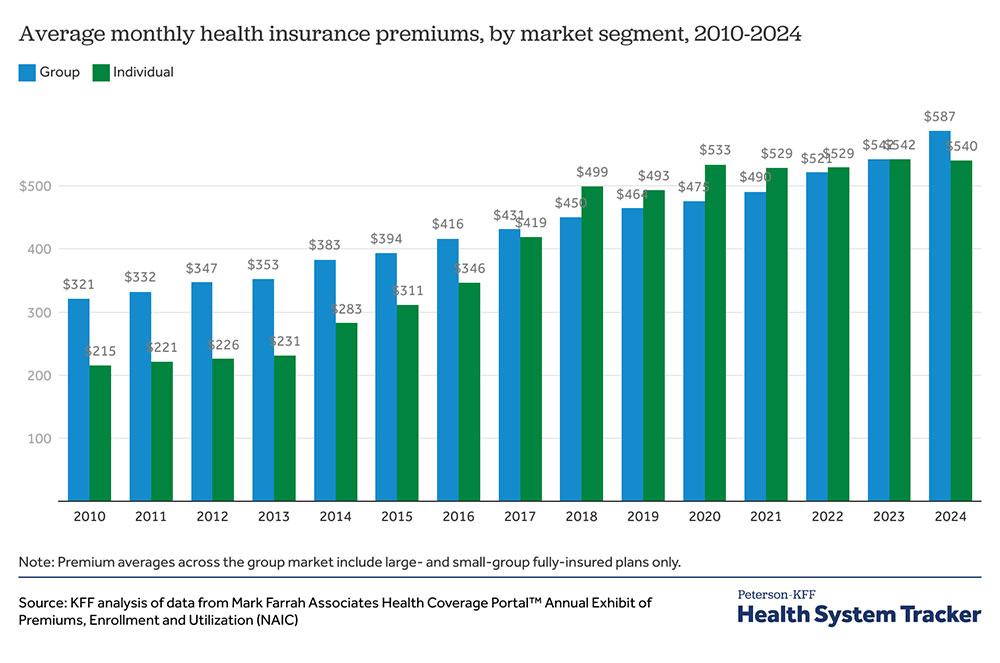

Well, as best as I can tell, it came from a bar graph in a KFF analysis from last month which compares ACA individual market premiums to Employer-Sponsored Insurance (ESI) premiums over time:

Sure enough, this graph puts average individual market premiums at $215/month back in 2010. So, kudos to Lankford on that specific claim, I suppose.

HOWEVER...there's a couple of important caveats right off the bat.

For starters, while the ACA was signed in 2010, individual market policy regulations didn't kick in until 2014, which means the more reasonable starting point is 2013, when average premiums were $231/month, not $215.

In addition, there's a clear discrepancy between the averages shown in this graph (which is based on data from Mark Farrah Associates) and the yearly averages at the top of this post (which are also via KFF, but which come directly from the Centers for Medicare & Medicaid Services):

As you can see, the CMS averages are consistently higher than the Mark Farrah averages, ranging from 11.6% - 24.5% higher for the years covered by both data sets.

There's a number of reasons for this discrepancy, but the point is that if Lankford is going to use the Mark Farrah data for his 2010 claim, it means he also has to use it for the increases since then...which means accepting an average of $540/month in 2024.

I've also filled in the missing years for both data sets assuming the percent increase in the KFF data also applies to the Farrah data, which makes them look like the following graph. In short, using Lankford's own logic, ACA filings only went up 139% from 2013 (the last year prior to ACA regulations going into effect) and 2025. This is still dramatic, of course...but a hell of a lot less dramatic than he suggested.

Lankford's response to Hunt's point about individual market policies being completely different before & after the ACA went into effect is also complete nonsense:

"That that's true...But I would tell you even when they looked at a plan that is similar to what is a what is called a silver plan now where you had protection for pre-existing conditions which I completely support. Everybody in Congress completely supports that. Even if you look at a plan like that, it has gone up well over 200% during that time period.

The entire point of the ACA is that, as my friend Louise Norris points out, plans like that DID NOT EXIST IN THE INDIVIDUAL MARKET IN MOST STATES PRIOR TO THE ACA.

There were only five states where individual market plans included guaranteed issue prior to the ACA...and no, Oklahoma wasn't one of them (for the record, those five were Massachusetts, Maine, New Jersey, New York and Vermont).

Again, tomorrow, in Part Two, I'll do a deeper dive in to why individual market premiums have indeed increased significantly since the ACA went into effect.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.