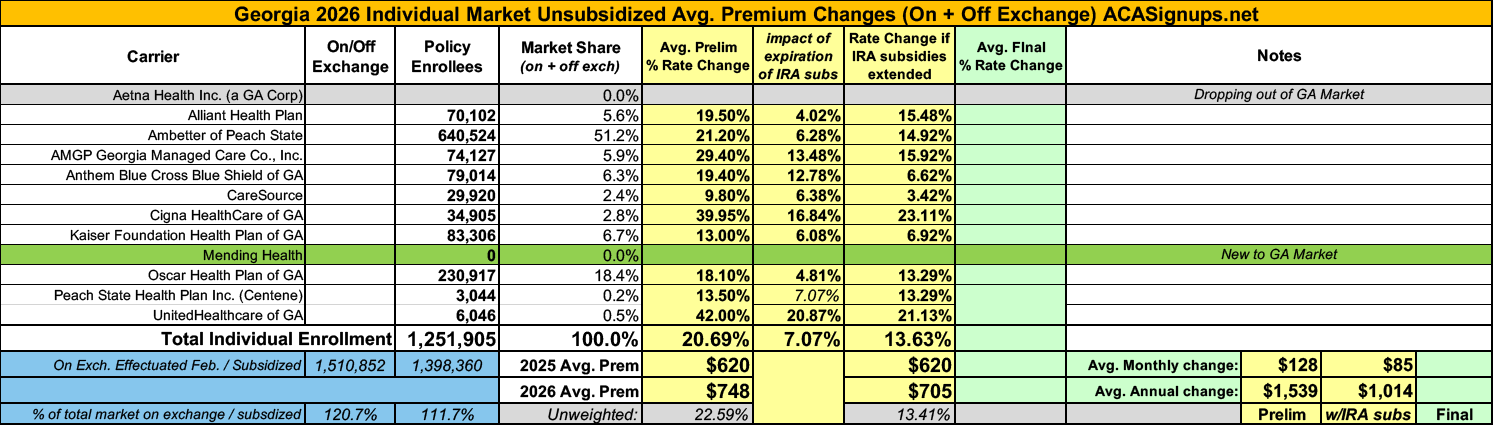

2026 Rate Changes - Georgia: +20.7%; 7.1 pts due specifically to IRA subsidy expiration (updated)

It's a little awkward to try & pull quotes from Georgia's actuarial memos because they're heavily redacted (see attachments below), but fortunately I also have access to other "just the facts" filing documents which include the hard data I need to compile my weighted averages. These forms--officially called "Rate Filing Transmittal Form LH-T1" and "Unified Rate Review" forms--include, among lots of other numbers, the preliminary avg. rate change being requested for the carrier's individual (or small group) market plans, as well as the number of current effectuated enrollees they have.

In addition, I have alternate rate filings for Georgia individual market carriers which specifically state what their requested rate changes would be if the enhanced premium tax credit subsidies provided by the American Rescue Plan Act & Inflation Reduction Act were to be extended for at least one more year, providing a clear apples to apples comparison.

Overall, Georgia ACA carriers are requesting a weighted average increase of 20.4%...which happens to be almost exactly the average of the 18 other states I've compiled preliminary analyses of. If the IRA subsidies were to be extended, the weighted average increase for unsubsidized enrollees would be 6.8 points lower, or 13.6%.

It's important to note that the combined enrollment of all 9 carriers (Mending Health is newly entering the market this fall, while Aetna/CVS is dropping out of the entire ACA exchange market nationally) only totals around 1.2 million people. This is a bit of a head-scratcher as on-exchange enrollment alone is over 1.5 million in Georgia this year; with off-exchange enrollees included it's likely more like 1.6 million.

Now, a chunk of the "missing" ~400K or so can be found in Aetna/CVS policies, although there were only around 94,000 enrolled via Aetna/CVS in 2024, so unless they quadrupled their ACA individual market enrollment this year (possible but not likely), I'm not sure what would account for the remaining ~300K or so.

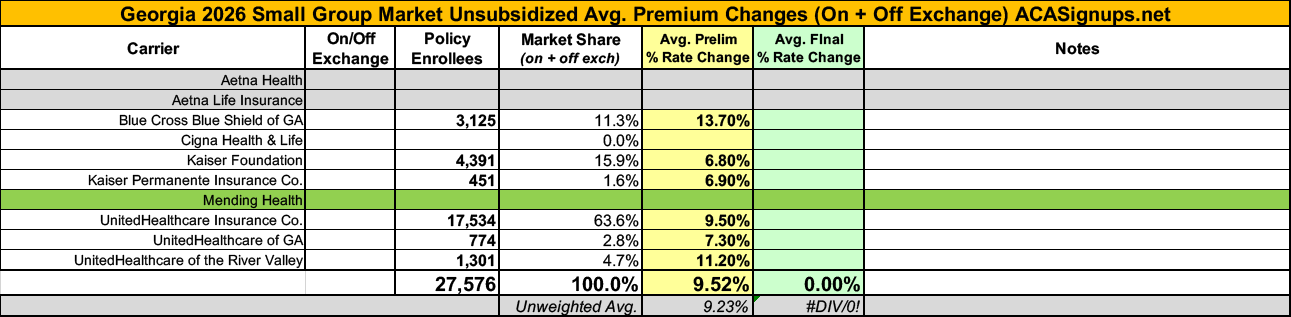

Anyway, that's the GA indy market. I only have one of the filings for the small group market in the Peach State, so I'll hold off on posting that table for now.

UPDATE 7/23/25: I've found additional documents in the filing records which bump up the enrollment for a few of the carriers slightly, along with a just-released filing for a 10th carrier (Peach State Health Plan). Combined, these nudge the total enrollment up by around 50,000 more people while also nudging the weighted average rate hike up slightly more (to 20.7%). The portion due to IRA subsidy expiration is also slightly higher at 7.1%

The table below has been revised with these updates:

UPDATE 7/23/25: Meanwhile, I've also acquired the filings for the small group market carriers (except for one, Cigna, which may be dropping out of the market?). Overall they're looking at a relatively modest (at least compared to the indy market) rate hike of 9.5% on average.